Tax Exemption on Tips: Key Information for Businesses and Employees

On July 4, Congress enacted a comprehensive tax and spending bill which includes provisions that significantly influence both individual taxpayers and business operations across the country. One of the provisions that has garnered considerable attention concerns the elimination of federal income taxes on certain tipped wages, a move poised to affect millions of workers in the service industry.

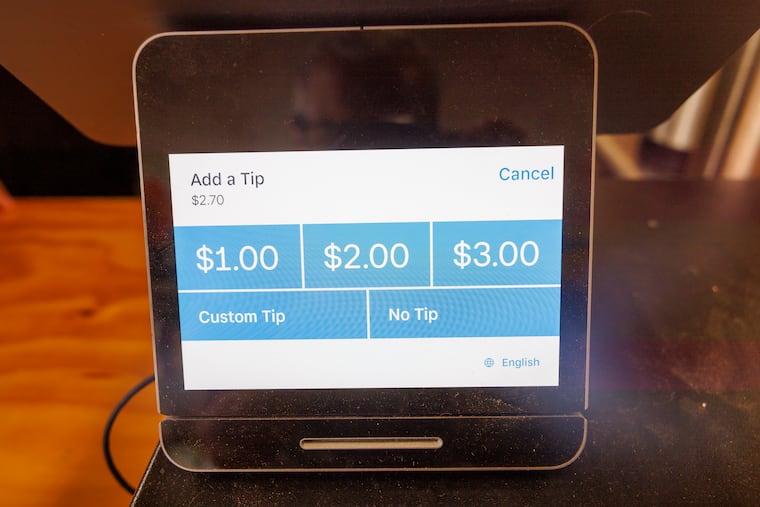

Under the new ruling, a maximum deduction of ,000 per year is available for tipped income, which is defined as voluntary payments made by customers in the form of cash, credit cards, or tip-sharing systems. However, this deduction begins to phase out for individuals with a Modified Adjusted Gross Income (MAGI) exceeding 0,000 for single filers and 0,000 for those filing jointly.

Despite the seeming benefits, limitations exist, especially for self-employed individuals, where the deduction cannot surpass net income derived from their business activities. Analysts indicate that approximately one-third of workers may not experience any advantage from this newly established rule, primarily because their earnings fall below the federal income tax threshold.

Various taxes remain applicable despite this new exemption. Employees will still be liable for Social Security (FICA) and Medicare taxes, along with their employers’ corresponding contributions. Additionally, local and state taxes may further apply, presenting a more complex financial landscape for workers and employers alike.

Eligibility for this deduction is confined to a specific category of workers. A total of 68 different job classifications are included, spanning industries such as hospitality, entertainment, and personal services. Notably, jobs like bartenders and wait staff are on the list, alongside less conventional roles such as electricians and private event planners. This proposed list is anticipated to be officially documented in the federal register imminently.

Furthermore, local employers in some states benefit from reduced minimum wage regulations for tipped employees, as these employees are expected to compensate the wage disparity through tips received. For example, Pennsylvania permits employers to pay as little as .83 per hour under this system, highlighting the nuanced interplay between federal and state regulations.

Moving forward, the reporting process for qualified tipped income will evolve, necessitating changes to W-2 forms starting in the 2026 tax year. Employers should prepare for these amendments and ensure they have the necessary systems in place for accurate tracking and reporting.

Lastly, it is important to note that the benefits of these changes will only apply for tax years 2025 through 2028. As this window aligns with the upcoming presidential election cycle, the future of this provision may become a topic of political debate. For eligible individuals, the deductions associated with tipped income could yield substantial savings on federal taxes, while potentially qualifying them for additional tax credits by lowering their adjusted gross income. Accordingly, it is advisable for both employers and employees to stay informed and pro-active regarding these evolving tax regulations.

With these changes in place, understanding the new landscape of tax benefits associated with tipped income becomes crucial for both businesses and their employees as they navigate this transformative period.

(Media News Source)