Toy makers rapidly adopt ‘blind box’ trend this holiday season after surge in popularity from Labubu-inspired products.

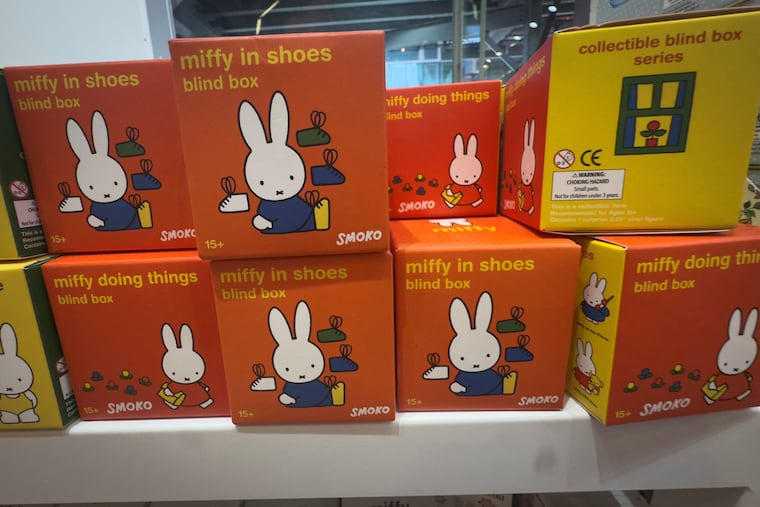

In recent months, the popularity of collectible blind box toys, particularly the Labubu series from Pop Mart, has surged among U.S. consumers, prompting a wave of competition from rivals aiming to capitalize on this trend during the critical holiday shopping season. Retailers such as Walmart and Target are expanding their offerings of blind box figurines and trading cards, while major toy manufacturers including Hasbro and Mattel are getting in on the action by packaging popular characters like Furby and Barbie in mystery boxes, designed to entice collectors and shoppers alike.

The phenomenon surrounding Labubus, characterized by their “ugly-cute” design and distinctive toothy grins, has ignited considerable excitement among consumers. These toys are not only difficult to find but also tend to sell out rapidly, often leading to resales on platforms like eBay for prices reaching hundreds or even thousands of dollars. Consequently, mainstream retailers and toy industry analysts predict that blind box toys will become top sellers this holiday season. They are lauded for their affordable price points, addictive appeal, and broad demographic reach, which includes both children and adults. For instance, Target has reportedly doubled its inventory of blind box products for this year’s holiday season, introducing various brands such as Baby Three and MGA Entertainment’s Miniverse.

Market research from Circana highlights an ongoing trend toward increasing sales of collectible toys, including trading cards like Pokémon, which have led the toy sector to rebound after a period of stagnation. However, while the excitement surrounding blind boxes may drive sales, it is important to note that these products have historically been marketed as year-round impulse purchases, which could limit their overall impact on holiday revenue. The last quarter of the year typically constitutes approximately 40% of the annual sales in the toy industry, yet Circana anticipates that the overall sales volume may dip by up to 2.5% during this peak season.

Despite potential challenges in the broader toy market, specialty retailers such as Miniso, Ohku, and Showcase are expected to benefit immensely from the rising demand for blind box collectibles. Miniso, which has over 200 locations across the United States, is gearing up for the holiday rush, offering a wide range of figurines from beloved franchises like Peanuts and Disney Pixar. Ohku has also announced the launch of a new blind box series, with planned availability through major online marketplaces, while Showcase, which features authentic Labubus among its inventory, anticipates significant sales growth from blind box products this holiday season.

Analysts suggest that the allure of surprise and the “chase” associated with collecting these toys contribute to their popularity. As we approach the holiday shopping season, the blind box toy market is poised for what could be a record-breaking period, driven by the confluence of consumer enthusiasm and strategic retail initiatives.